How small businesses can survive and thrive in a recession — part one

Recessions are especially hard on small businesses. Few small firms have the resources to stay the course and wait out the bad times. Credit is scarce, and budget cutting difficult. In a small operation, there are not that many places to cut. But there are things small businesses can do to improve their odds of success, according to the W. P. Carey School's experts in management, marketing, and entrepreneurship. In Part One of a contnuing Knowledge@W. P. Carey series, experts describe how small firms can successfully navigate a recession and sometimes emerge from the bad times stronger than before.

Recessions are especially hard on small businesses. Few small firms have the resources to stay the course and wait out the bad times. Credit is scarce, and budget cutting difficult. In a small operation, there are not that many places to cut. "It's always easier to tip over a small boat," says W. P. Carey School Assistant Dean Andrew Atzert, who organized the school's Small Business Leadership Academy two years ago.

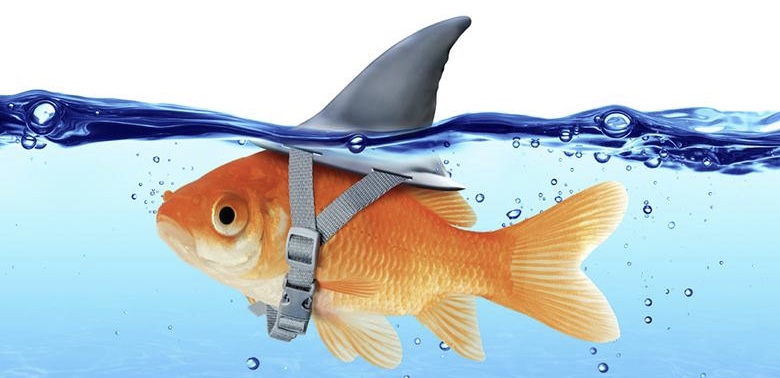

"When seas are rough, it's that much easier." But there are things small businesses can do to improve their odds of success, according to the W. P. Carey School's experts in management, marketing, and entrepreneurship. By being aware of both risks and opportunities and by paying attention to long-term strategy, small firms can successfully navigate a recession and sometimes emerge from the bad times stronger than before, these experts say.

"Small businesses need to step back and decide what is the core of their competitive advantage," says Executive Dean Amy Hillman, chair of the Management Department. "In a bad economy, you have fires to put out every day, and you think it's the time you can afford least to step back and look at the big picture. I think it's the best time to do it."

Associate Professor of Management S. Trevis Certo is faculty director of the 10-week Small Business Leadership Academy, the business school's streamlined continuing education program for small business owners and managers. He believes that in a recession small businesses must focus on keeping existing customers.

Sometimes this means holding down prices by cutting costs, he says, while other times it means changing their product or services to differentiate it from the competition. "If small businesses can survive this period, then they'll be in a good position when the economy finally makes its turn," Certo says.

Rule number one: Don't panic

When a recession hits, small business owners and managers can have any number of reactions, and some only make the problem worse, according to W. P. Carey experts. One particularly unfortunate response to a downturn is to cut everything — budgets, inventory, personnel, and prices.

"If you just cut everything 25 percent, in some respects, that's the easy way out," says Gary C. Naumann, a management lecturer and director of entrepreneurial initiatives. "You haven't thought about it, and you haven't looked at each item. You need to examine every aspect of the business to decide what is mission critical." Hillman agrees.

"You can get into a panic mode where you're basically chasing your own tail. You see a lot of activity and churn and turmoil," she says. Retailers have to be judicious about trimming inventory, according to Naumann. "If you cut your inventory to the bone, everybody will notice. People will wonder if you're going to be around. It's like a self-fulfilling prophecy." Another mistake small businesses make is to stop advertising and promoting themselves, Naumann says. "In retail, that can be a death spiral."

There are ways a small business can promote itself without a big advertising budget, according to Naumann. He advises owners of small firms to try to get on local radio shows or to pitch story ideas to newspapers. And he says they should stay visible by attending community functions. "Sometimes it's just a matter of being the number one promoter of your business," Naumann says.

Marketing Professor Michael Denning suggests viral marketing for small businesses that don't have a big promotion budget. With a small initial investment, a business can get its message out, then watch it spread widely via social media. "It allows you to take a few dollars and put something out into the marketplace," Denning says. "If it's successful, it multiplies by itself, as like-minded people start talking about it to other people."

Serving your customers

Paying attention to customers — a key strategy for any business in a recession — means focusing on services, management experts say. "Even if you're a company that sells goods — safety gloves, fire extinguishers, clamps, or tools or whatever — the service that you provide along with the product can be the key differentiator between you and your competitors," Atzert says.

Professor of Marketing Amy Ostrom, who teaches a course on services for the Small Business Leadership Academy, says, "In tough times, it's critical to provide the best services possible." Ostrom encourages organizations to use a technique known as "services blueprinting" to improve the experiences of customers.

Developed over 20 years ago by a bank executive, services blueprinting is a group exercise in which members of an organization gain the perspective of customers and also learn how the roles of different players in the organization affect customers' experiences.

"By providing the best services you can to your customers, you enhance the likelihood you'll be able to keep them," Ostrom says. For a small business, providing new or better services separates you from your competitors, according to Atzert. "You're making yourself a more valuable supplier, and often you're also producing a new income stream because you sell the service," he says.

Communicating problems and solutions

A recession takes a toll not only on the bottom line but also on the psyche. Business owners cannot help but be affected emotionally as they watch hard earned gains being wiped out by forces beyond their control. But despite these pressures, small business owners and managers need to put up a brave front, according to management experts.

Closeting yourself in your office or walking around with your head down, will only spread the gloom to employees and everyone else you deal with, experts say. "You don't have to be Pollyanna," Naumann says. "You can't say, 'Every thing's great and we have nothing to worry about.' You have to be realistic and say, 'These are our problems. Here's how we're going to attack them.'"

It's especially important to keep communicating even when things have taken a turn for the worse, Naumann says. Everyone — employees, suppliers, lenders, and customers — wants to know what is happening. "The expression 'no news is good news' is absolutely not true in this case," Naumann says. "If people hear nothing, they assume the worst."

When being small is an advantage

While recessions are rarely good news for any business, they can present opportunities, especially for firms that can take the long view. "There are companies that have thrived in this downturn," Denning says. "In a recession, there is always some panic, and businesses withdraw from markets. People who see those openings can capitalize on them."

The niches that these opportunistic businesses occupy may be small, but markets can grow as the economy recovers. "The customers are still there," Denning says. "They may not be buying as much as they were before but they're still buying." Another feature of recessions is layoffs. And an employee shed by one firm can be a valuable pickup for another, according to Denning.

"You have an opportunity to attract into your business some skills and abilities you would not normally be able to. People are willing to work for a smaller or more risky venture," Denning says. Small businesses also have an important advantage over large firms. Unburdened by large bureaucracies, they can shift strategies more quickly. "They're definitely more flexible," Certo says. "They can shift quickly in a changing environment."

Bigger companies typically can cut costs more steeply and more quickly than small firms, according to Certo. "But that opens the door. As larger companies focus on cost, smaller companies have the opportunity to differentiate what they offer," he says. Naumann says that small business owners who can focus on the fundamentals and stay positive are poised for success as the economy revives. "These are things that you can do," he says. "They are under your control."

Bottom Line:

- In a recession, small businesses need to step back and assess their long-term strategies. This often means resisting impulses to slash jobs, inventories, and marketing.

- Focusing on providing high quality services is an important strategy for small businesses in a recession. Good services can separate a business from its competitors and help it to retain customers.

- Small business owners and managers must stay visible and positive in a recession. Keeping communications open with employees, suppliers, lenders, and customers builds the trust and cooperation needed to overcome challenges.

- Recessions can present opportunities for small businesses. Some firms will vacate markets when hard times hit, and these openings can be filled by other companies. Also, small businesses can hire talented people who have lost their jobs at larger firms.

Latest news

- Ethical leadership: Good policy may prompt bad behavior

New research findings reveal how managerial approaches to integrity influence team morale and…

- W. P. Carey alum Paridhi Saboo found passion for analytics and real estate during undergraduate journey

Thanks to the many opportunities available to students at W. P.

- Here's how artificial intelligence is impacting health care

Artificial intelligence is rapidly becoming integral to every facet of health care, from…